Which Of The Following Activities Is Not A Service Provided By Investment Bankers

Investment Banking

Overview of the investment banking manufacture

What is Investment Cyberbanking?

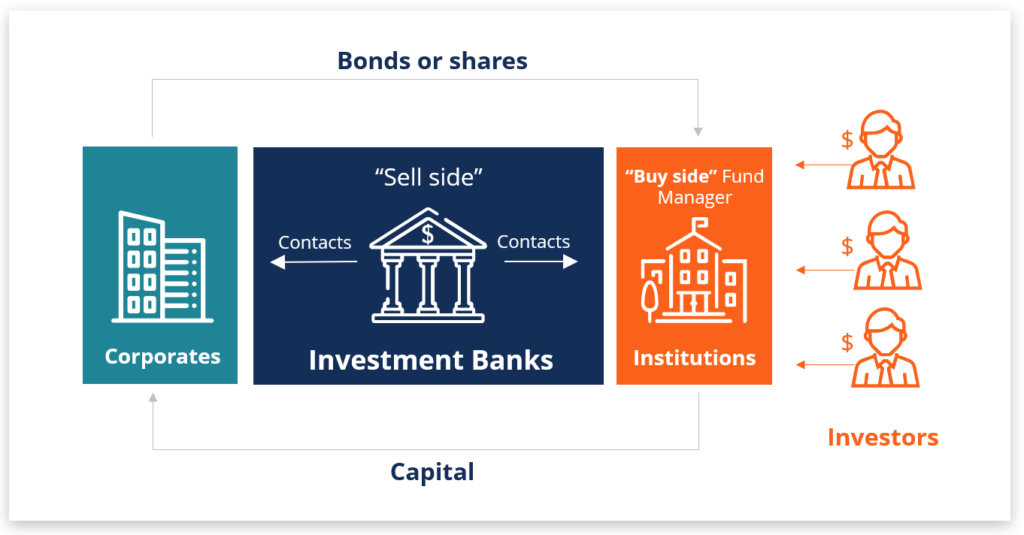

Investment banking is the division of a depository financial institution or financial institution that serves governments, corporations, and institutions past providing underwriting (upper-case letter raising) and mergers and acquisitions (Thou&A) advisory services. Investment banks act equally intermediaries between investors (who have money to invest) and corporations (who require upper-case letter to grow and run their businesses). This guide volition cover what investment banking is and what investment bankers really practice.

Image: Free Intro to Corporate Finance Course.

What Practice Investment Banks Do?

In that location can sometimes be confusion betwixt an investment bank and the investment banking division (IBD) of a bank. Total-service investment banks offer a wide range of services that include underwriting, M&A, sales and trading, equity enquiry, asset management, commercial cyberbanking, and retail banking. The investment banking sectionalisation of a depository financial institution provides simply the underwriting and One thousand&A informational services.

Full-service banks offering the following services:

- Underwriting – Capital raising and underwriting groups piece of work betwixt investors and companies that want to raise money or go public via the IPO process. This function serves the primary marketplace or "new capital letter".

- Mergers & Acquisitions (M&A) – Advisory roles for both buyers and sellers of businesses, managing the M&A process start to end.

- Sales & Trading – Matching up buyers and sellers of securities in the secondary market. Sales and trading groups in investment banking human action equally agents for clients and too tin merchandise the firm's own capital.

- Equity Research – The equity research group research, or "coverage", of securities helps investors make investment decisions and supports trading of stocks.

- Asset Management – Managing investments for a wide range of investors including institutions and individuals, across a broad range of investment styles.

Underwriting Services in Investment Banking

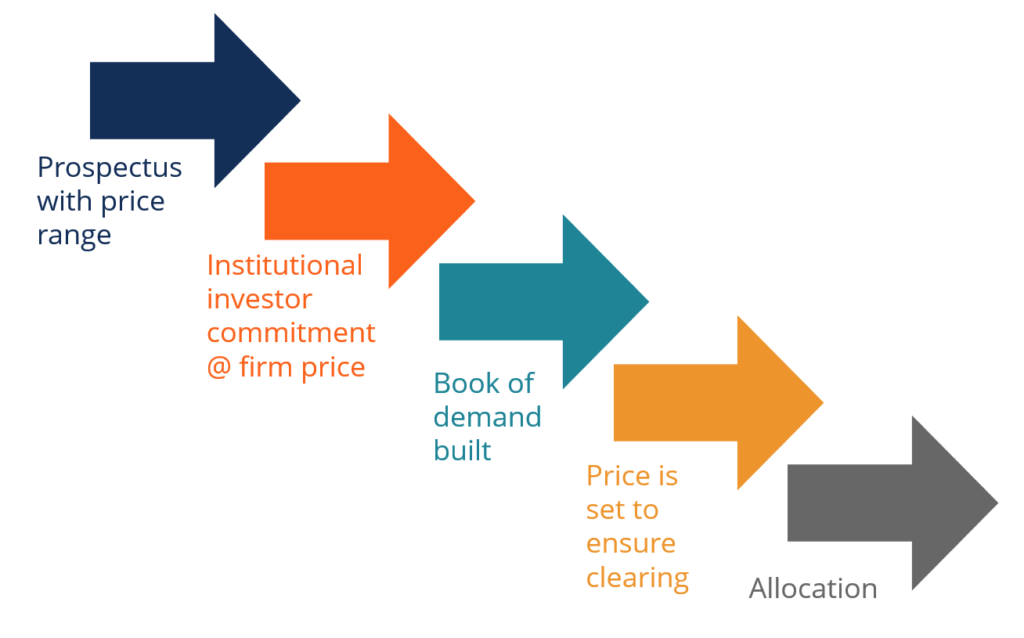

Underwriting is the process of raising capital letter through selling stocks or bonds to investors (due east.g., an initial public offering IPO) on behalf of corporations or other entities. Businesses demand money to operate and grow their businesses, and the bankers assist them go that money by marketing the visitor to investors.

There are more often than not three types of underwriting:

- Firm Delivery – The underwriter agrees to buy the entire issue and assume full financial responsibleness for any unsold shares.

- Best Efforts – Underwriter commits to selling as much of the effect as possible at the agreed-upon offering cost but can return any unsold shares to the issuer without financial responsibleness.

- All-or-None – If the entire issue cannot be sold at the offer toll, the deal is called off and the issuing company receives nothing.

Once the bank has started marketing the offering, the following book-building steps are taken to price and complete the deal.

Epitome: Free Intro to Corporate Finance Course.

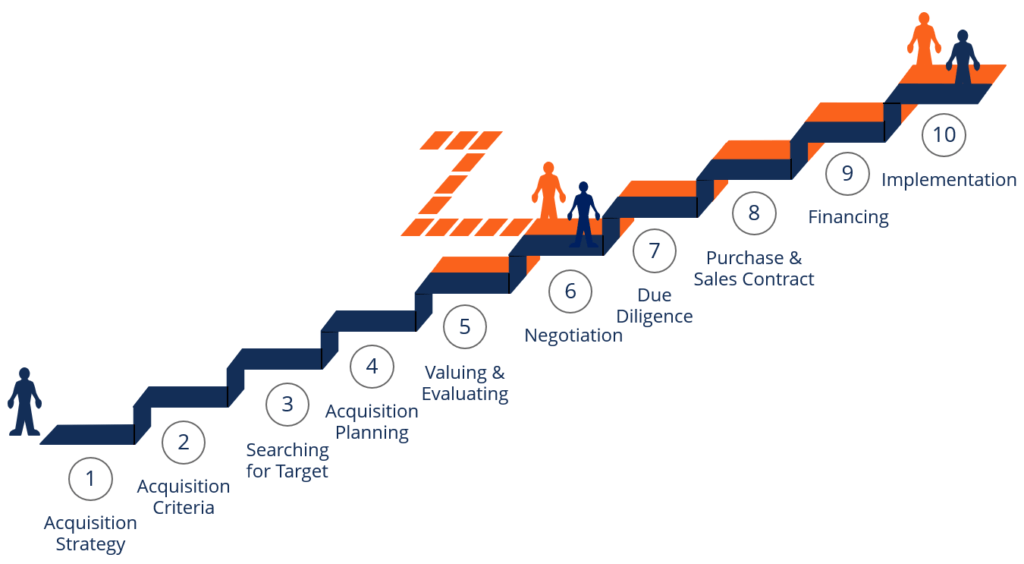

Yard&A Advisory Services

Mergers and acquisitions (M&A) informational is the process of helping corporations and institutions observe, evaluate, and consummate acquisitions of businesses. This is a cardinal office in i-banking. Banks utilise their extensive networks and relationships to find opportunities and help negotiate on their client's behalf. Bankers advise on both sides of M&A transactions, representing either the "buy-side" or the "sell-side" of the deal.

Below is an overview of the 10-step mergers and acquisitions procedure.

Cyberbanking Clients

Investment bankers advise a wide range of clients on their capital raising and M&A needs. These clients can exist located around the world.

Investment banks' clients include:

- Governments – Investment banks piece of work with governments to raise money, trade securities, and buy or sell crown corporations.

- Corporations – Bankers work with both private and public companies to help them go public (IPO), heighten additional uppercase, grow their businesses, make acquisitions, sell business units, and provide enquiry for them and general corporate finance communication.

- Institutions – Banks piece of work with institutional investors who manage other people's money to assist them trade securities and provide enquiry. They as well work with private equity firms to aid them acquire portfolio companies and exit those positions by either selling to a strategic buyer or via an IPO.

Investment Banking Skills

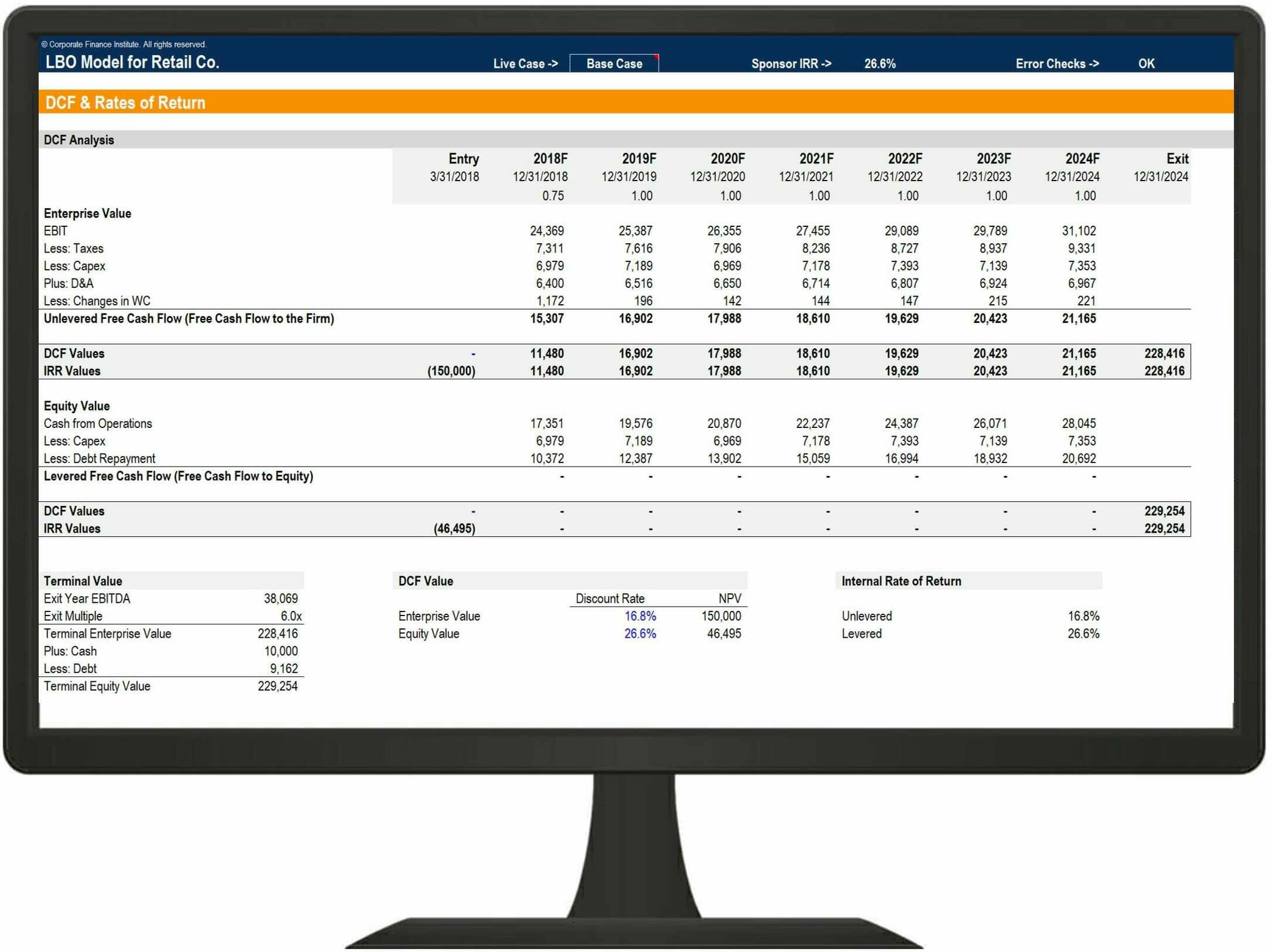

I-banking piece of work requires a lot of financial modeling and valuation. Whether for underwriting or Thou&A activities, Analysts and Associates at banks spend a lot of time in Excel, edifice financial models and using various valuation methods to advise their clients and complete deals.

Investment banking requires the following skills:

- Financial modeling – Performing a wide range of fiscal modeling activities such every bit building 3-argument models, discounted cash flow (DCF) models, LBO models, and other types of financial models.

- Business valuation – Using a broad range of valuation methods such as comparable company analysis, precedent transactions, and DCF analysis.

- Pitchbooks and presentations – Edifice pitchbooks and PPT presentations from scratch to pitch ideas to prospective clients and win new business concern (check out CFI's Pitchbook Course).

- Transaction documents – Preparing documents such equally a confidential information memorandum (CIM), investment teaser, term sail, confidentiality understanding, building a data room, and much more (check out CFI's library of free transaction templates).

- Relationship management – Working with existing clients to successfully shut a deal and brand certain clients are happy with the service being provided.

- Sales and business organisation development – Constantly meeting with prospective clients to pitch them ideas, offer them support in their work, and provide value-added advice that will ultimately win new concern.

- Negotiation – Being a major factor in the negotiation tactics between buyers and sellers in a transaction and helping clients maximize value creation.

The screenshot above is of a leveraged buyout (LBO) model from CFI'south Financial Modeling Courses.

Careers in Investment Banking

Getting into i-banking is very challenging. There are far more than applicants than at that place are positions, sometimes as high as 100 to i. Nosotros've published a guide on how to ace an investment banking interview for more than information on how to interruption into Wall Street.

In improver, y'all'll want to check out our example of real interview questions from an investment bank. In preparing for your interview information technology also helps to take courses on financial modeling and valuation.

The virtually common job titles (from most inferior to senior) in i-banking are:

- Annotator

- Associate

- Vice President

- Managing director

- Managing Manager

- Head, Vice Chair, or some other special title

Who are the Main Investment Banks?

The main banks, also known as the bulge bracket banks in investment banking, are:

- Bank of America Merrill Lynch

- Barclays Capital

- Citi

- Credit Suisse

- Deutsche Banking company

- Goldman Sachs

- J.P. Morgan

- Morgan Stanley

- UBS

View a total listing of the pinnacle 100 investment banks here. It is of import to note that in that location are many smaller firms, often called mid-market banks, and bazaar investment banks that make up a very large part of the market.

Video Caption of How I-Banking Works

Below is a curt video that explains how the uppercase markets function and who the primal players are. You tin can see more costless video tutorials on CFI'due south YouTube aqueduct.

Additional Resources

Thanks for reading CFI'due south overview of i-cyberbanking and how the manufacture works. CFI is the official global provider of certification courses for aspiring investment banking professionals. To learn more than about career paths and how to pause into banking, delight run across these additional resource:

- What is Fiscal Modeling?

- Valuation Methods

- Financial Modeling Guide

- Investment Banking Salaries

Which Of The Following Activities Is Not A Service Provided By Investment Bankers,

Source: https://corporatefinanceinstitute.com/resources/careers/jobs/investment-banking-overview/

Posted by: arnoldexperwas89.blogspot.com

0 Response to "Which Of The Following Activities Is Not A Service Provided By Investment Bankers"

Post a Comment